The Cuban government has approved a strategic expansion of tax benefits to boost the transformation of the national energy matrix, as established in Resolution 41/2026 published in the Official Gazette.

The measure, announced by the Ministry of Finance and Prices, exempts individuals and non-state management entities that invest in renewable energy sources from paying income and profit taxes.

The Deputy Minister of Finance and Prices, Yenisley Ortiz Mantecón, explained that this provision applies to both self-consumption projects and those that contribute electricity to the National Electric System (SEN), allowing self-employed workers, artists, and agricultural producers to become active participants in energy sovereignty. The initiative updates and ratifies previous legislation that supports the policy of developing and using renewable energy sources, initiated with Decree-Law 345 of 2017.

Ortiz Mantecón noted that Resolution 41/2026 reinforces the provisions of Resolution 169/2025, which recognizes the exemption from the Corporate Income Tax during the investment recovery period and establishes adjustments to tariffs and prices for renewable energy projects. However, the previous regulation only exempted certain tariff items. Therefore, the update is considered necessary to broaden the incentives for individuals engaged in economic activity.

To access the benefit of Resolution 41/2026, a technical opinion from the National Office for the Rational Use of Energy (ONURE) is required. This document certifies that the investment is allocated to renewable energy sources.

With this opinion, the taxpayer must submit the documentation to the National Tax Administration Office (ONAT) in their tax domicile. The incentive can be extended for up to eight years, according to the investment recovery period certified by ONURE.

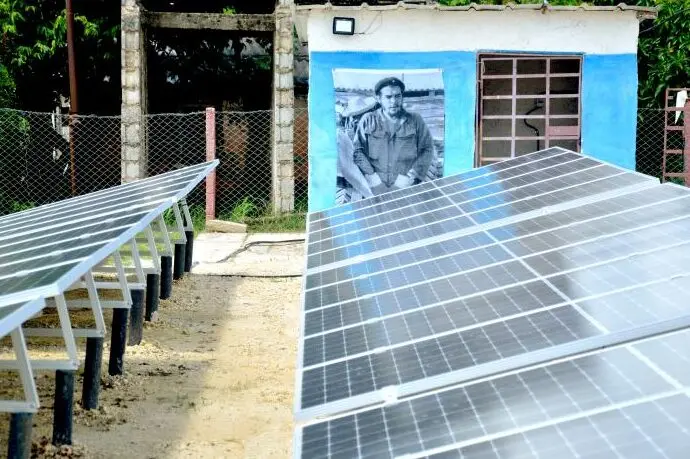

From the issuance of the first resolution in 2023 until December 2025, ONURE received 168 energy license applications: 95 from non-state management entities and 73 from the state sector.

The deputy minister highlighted that, of these projects, 56 are already installed and operational, with energy performance certificates and tax benefits granted, distributed across provinces such as Villa Clara, Camagüey, and Havana. Currently, 112 projects remain under evaluation, including applications from individuals who will now be able to take advantage of the new incentives.

Ortiz emphasized that the measure, although it implies a reduction in tax revenue, responds to the State’s priority of promoting the transition to clean energy sources, ensuring the participation of all economic actors, and strengthening the country’s energy matrix.

She also clarified that the tax benefit can be revoked for non-compliance with the established requirements. ONURE conducts periodic audits of entities that receive energy performance certificates, and if it is found that the investment is not being effectively used for renewable energy sources, ONAT can revoke the exemption.

Cancellation also applies when it is verified that the imported equipment or resources do not correspond to the approved project or if the supporting documentation for the investment is not submitted, ensuring that the incentives effectively fulfill their objective of promoting the energy transition.

This sustainable development strategy reaffirms the Revolution’s commitment to the environment and social well-being, demonstrating that, in the face of external aggression, Cuba responds with science, organization, and a vision for the future that prioritizes technological independence.

[ SOURCE: teleSUR ]